Click here to know more on the issue

Why in news?

The government has released a new notification easing norms for exemption from the angel tax under Section 56 of the Income-Tax Act.

Why was there a necessity for this notification?

- Under Section 56(2) of the I-T Act,Angel Tax are taxes on any investments made by an Indian entity in an unlisted Indian company above fair market value as income.

- The provision was introduced in 2012 with the intent of curbing the laundering of black money.

- However, this levyplaces the power to evaluate a company in the hands of Income Tax inspectors, whose valuation and methods are at odds with the start-up ecosystem and investors.

- This is because even the most experienced venture capitalists get valuations right very rarely.

- This mismatch between how investors evaluate a start-up and how the Assessing Officer (AO) does so lies at the heart of the unrest and distress within the community.

- Hundreds of start-ups that raised angel funding in AY2015-16 and 2016-17 have received notices from the Income Tax department.

- The notices question the high share premium at which the shares have been allocated during the funding.

- This has impacted angel investors as their investments typically exceed what is regarded as fair value.

What does the notification say?

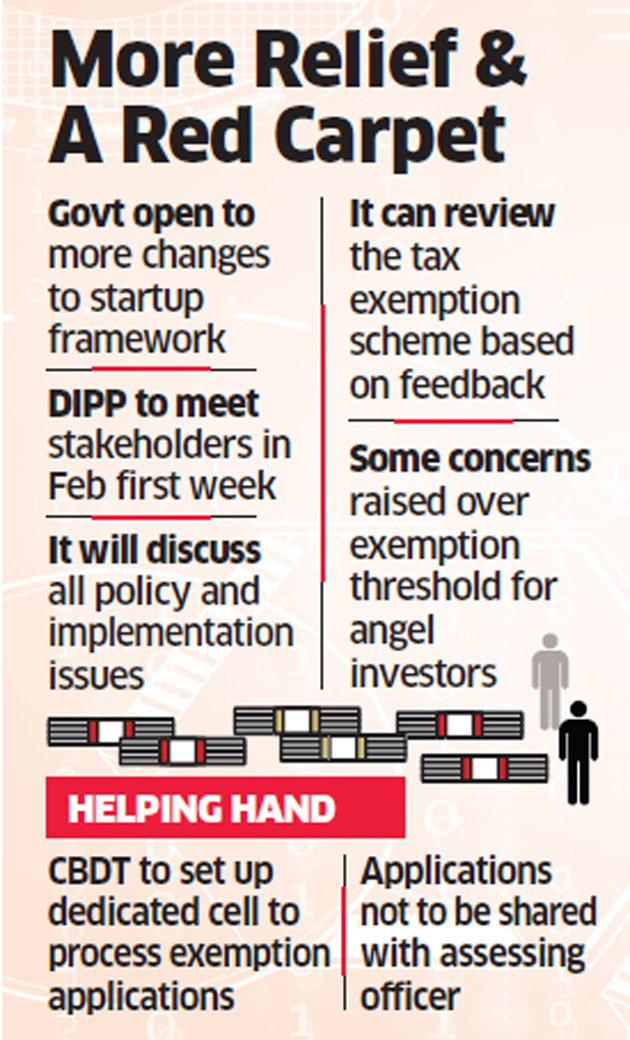

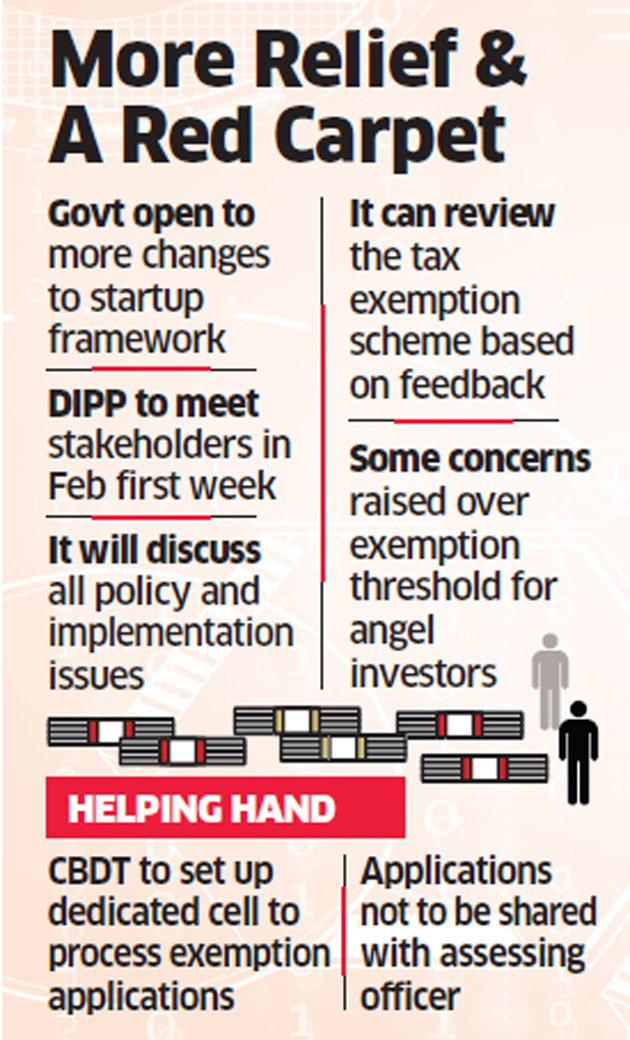

- On approval - As per the notification, certification from an inter-ministerial body for seeking exemption from angel tax has been done away with.

- Now, a start-up can fill up a form with the requisite documents and submit it to the Department of Industrial Promotion and Policy (DIPP), which will forward it to the Central Board of Direct Taxes (CBDT).

- The CBDT is mandated to evaluate and respond to each application within 45 days.

- Besides, the CBDT will soon set up a dedicated unit for processing requests from startups and angel investors for exemption to expedite the process.

- For start-ups - The aggregate amount of paid-up share capital and share premium of the start-up after the proposed issue of share does not exceed 10 crore rupees.

- For investors - The investor shall have a returned income of Rs 50 lakh or more for the financial year preceding the year of investment and net worth exceeding Rs 2 crore.

- The exemption provision will be applied with retrospective effect from April 2016.

What are the concerns with the notification?

- Eligibility - The angel investors, to be eligible for tax exemption, are required have a declared income of Rs 50 lakh or more and net worth exceeding Rs 2 crore.

- For a lot of start-ups, the first investors are friends and family members and most of them would not be able to fulfil this criterion.

- Also, the provision requires the investors to share their source of funds with the start-up seeking an exemption.

- Thus, instead of fulfilling both criteria of income and net worth, they should follow the global model of fulfilling any one criteria.

- Also, lowering the threshold to Rs 25 lakh of income or a net worth of Rs 1 crore could be considered.

- Exemption limit - The exemption limit of Rs 10 crore is arbitrary and it affects capital flow for a start-up.

- This is because raising further rounds of funding are important accelerants to growth and business development for a start-up.

- Also, it is not clear whether the exemption provisions apply to both a transfer as well as the issuance of fresh shares.

- Discretion – Though some norms have been eased, the procedure to apply for exemption still remains cumbersome.

- The new procedure to seek exemption involves an application made by the start-up to the CBDT, via DIPP.

- Thus, the DIPP has the discretion in either clearing exemption or raising tax demands.

- Assessment of fair value - The angel tax is calculated with the help of “fair value” of a new business.

- But fair value is impossible to ascertain for an unlisted new business.

- A new business has no track record and it may be light on assets as well, especially if it is in the services sector.

- Hence, it is impossible to judge, whether any given valuation is fair or not.

- Thus, instead of the asset-based evaluation of companies, the Discounted Cash Flow (DCF) method should be followed, which takes into account future growth prospects.

- This method would be much more accurate to assess fair value for asset-light technology start-ups.

Source: Business Standard, The Quint