900 319 0030

enquiry@shankarias.in

Why in news?

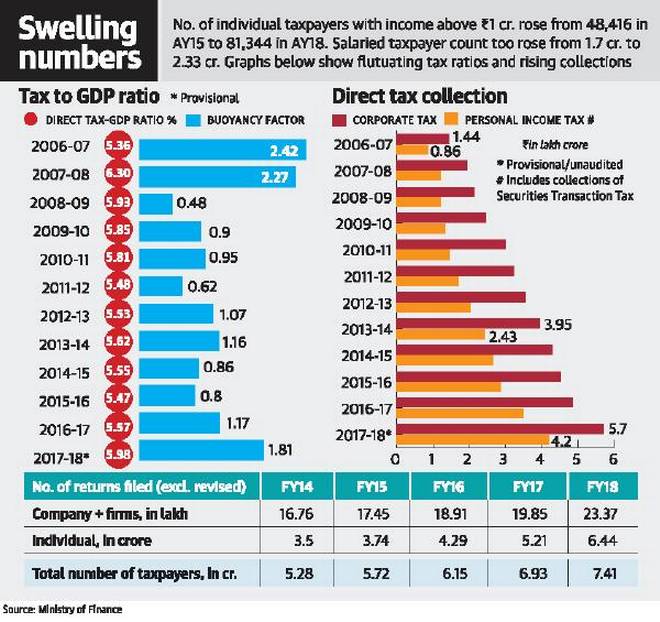

The Central Board of Direct Taxes (CBDT) recently released the new time series data (same data points recorded at regular intervals) as updated up to FY 2017-18.

What are the highlights?

What were the driving factors for widening tax base?

What is the concern with direct taxes share?

What lies ahead?

Source: The Hindu, Indian Express, Business Standard