900 319 0030

enquiry@shankarias.in

Why in news?

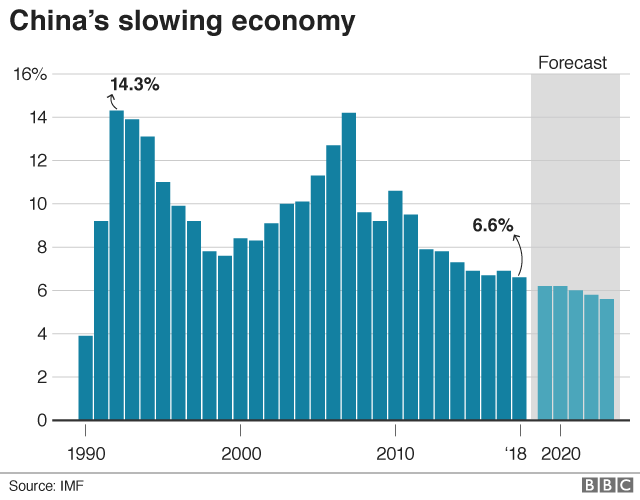

The growth of gross domestic product (GDP) in the People’s Republic of China (PRC) has slowed to 6.6% in 2018.

Why is it a concern?

What is the cause?

What should China do now?

What are the challenges therein?

What does this mean for India?

Source: Business Standard