900 319 0030

enquiry@shankarias.in

Why in news?

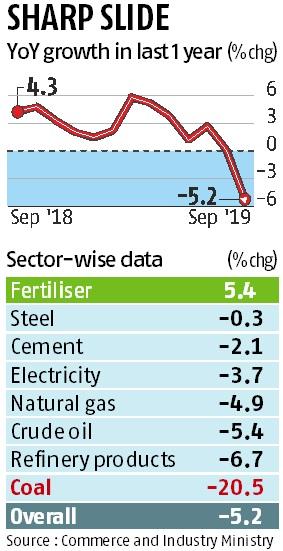

The latest set of economic data on the growth of the core sector industries was released recently.

What is the core sector index?

What are the highlights?

What do the figures imply?

What are the further challenges?

What lies ahead?

Source: Economic Times, The Hindu