900 319 0030

enquiry@shankarias.in

Why in news?

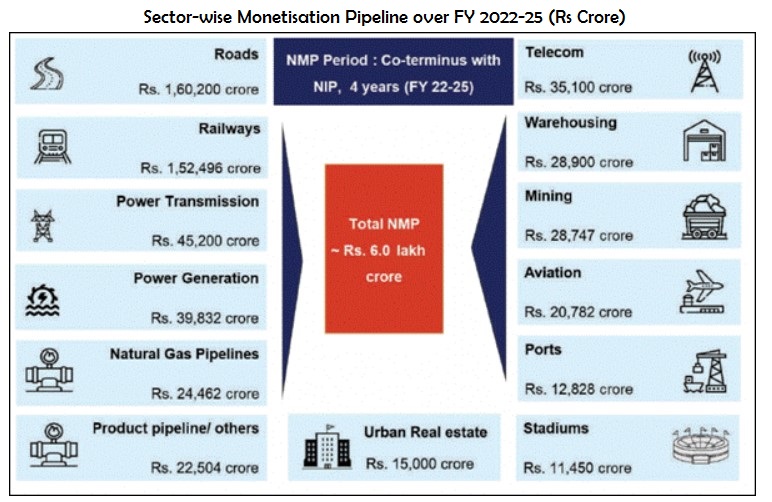

The Union government has announced its plans to “monetize” about Rs 6 trillion worth of assets held by it, and public sector units (PSUs), under the National Monetisation Pipeline (NMP).

What is monetisation?

What are the other models?

What is the National Monetisation Pipeline?

Greenfield investment - A company will build its own, brand-new facilities from the scratch

Brownfield investment - A company purchases or leases an existing facility.

What are the key assets identified?

What are the challenges and risks?

What should be done?

Source: The Hindu, The Wire, The Indian Express, Economic Times