900 319 0030

enquiry@shankarias.in

Why in news?

RBI has released data on sectoral deployment of bank credit.

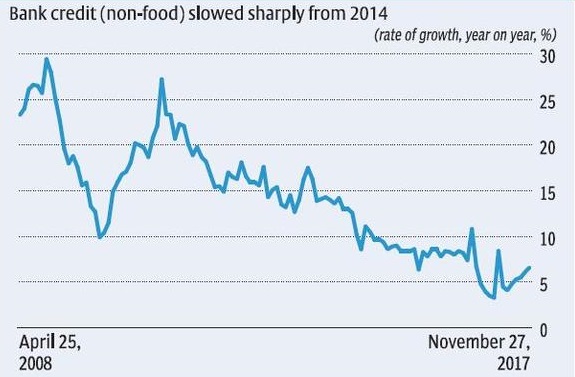

What is the status of total non-food credit deployed?

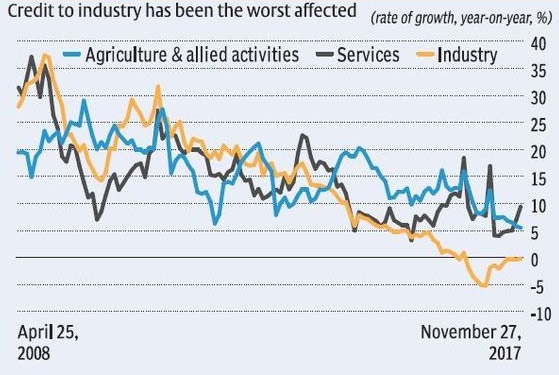

What is the status of credit deployment to industries?

What is the status of credit deployment for MSMEs?

What are the reasons behind falling credit rates?

Source: Business Line