900 319 0030

enquiry@shankarias.in

Why in news?

The oil prices of West Texas Intermediate (WTI), the best quality of crude oil in the world, fell to “minus” $40.32 a barrel in New York, US.

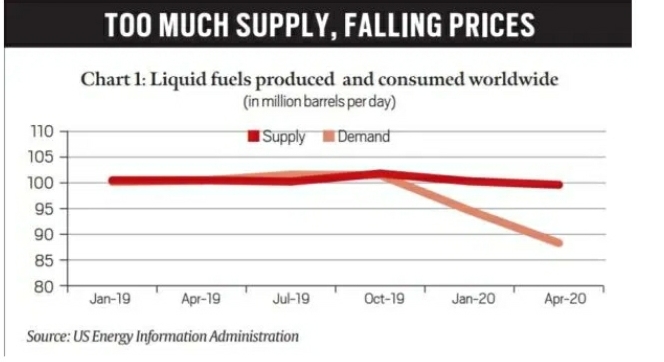

What is the key reason?

What are the other recent developments?

How has the lockdown worsened the situation?

What is the immediate cause?

How does the future look?

Source: Indian Express