900 319 0030

enquiry@shankarias.in

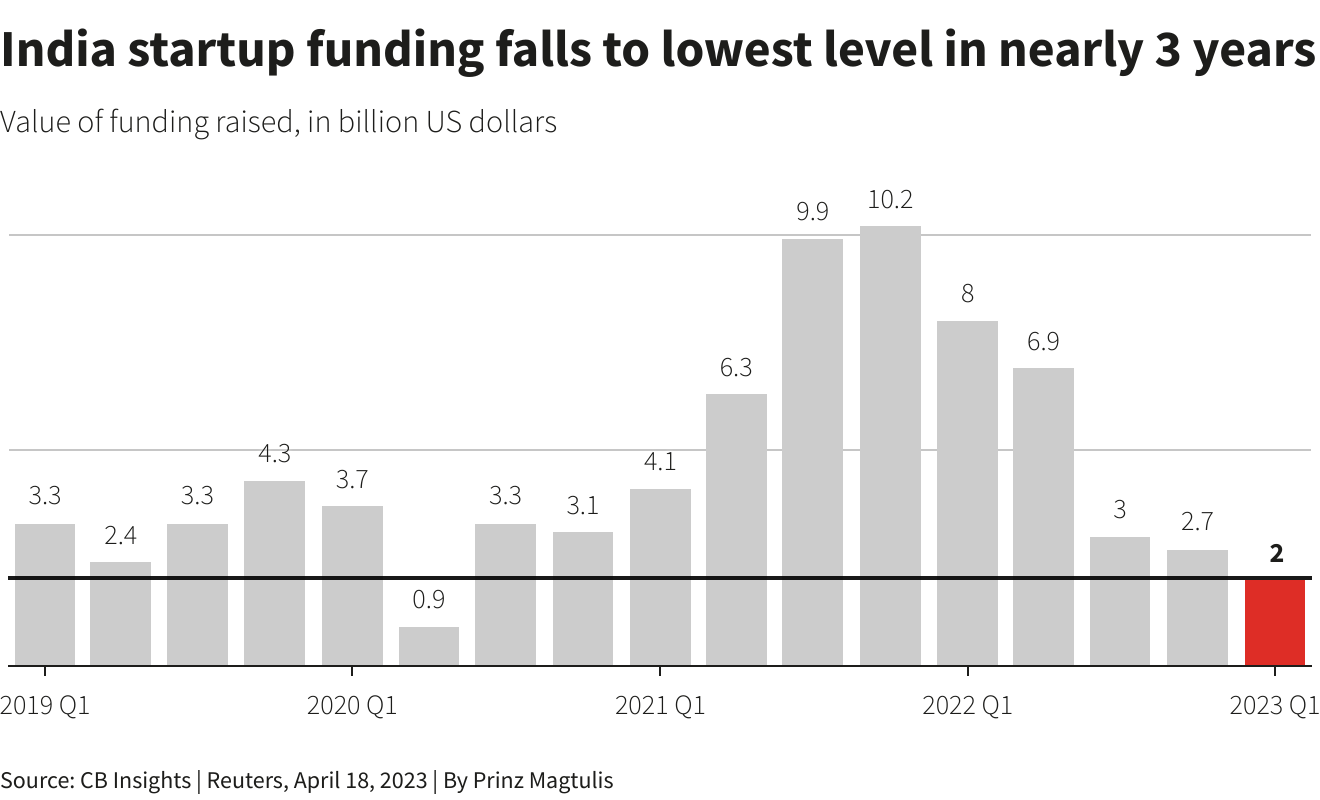

Due to interest rate hikes of global central banks and the ongoing banking crisis in the US, startups are facing difficulties in fund-raising.

India had become the 3rd largest startup environment in the world as of August, 2022.

India has the 3rd highest number of unicorns in the world next to US and China.

References