900 319 0030

enquiry@shankarias.in

Why in news?

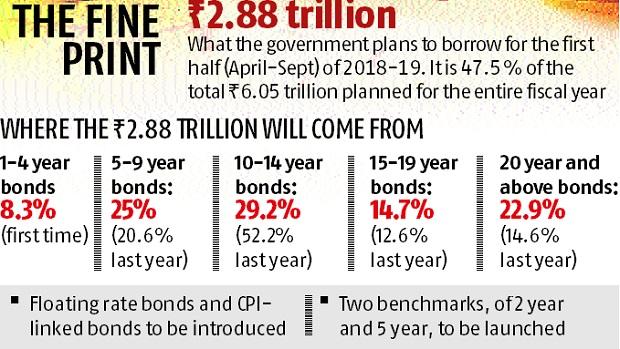

Union government plans to borrow Rs 2.88 trillion in FY 2018-19.

What is union government’s plan on borrowing?

How this borrowing has been planned?

What are the benefits of this move?

Source: Business Standard