PART A

SCOPE FOR INDIA

AMRIT KAAL

PRIORITY 1: INCLUSIVE DEVELOPMENT

A. AGRICULTURE AND COOPERATION

India is the largest producer and 2nd largest exporter of Shree Anna in the world

B. HEALTH, EDUCATION AND SKILLING

PRIORITY 2: REACHING THE LAST MILE

PRIORITY 3: INFRASTRUCTURE & INVESTMENT

Operating ratio is the amount of money the railways has to spend to earn Rs 100. A lower operating ratio implies better financial health

PRIORITY 4: UNLEASHING THE POTENTIAL

PRIORITY 5: GREEN GROWTH

PRIORITY 6: YOUTH POWER

PRIORITY 7: FINANCIAL SECTOR

PART B

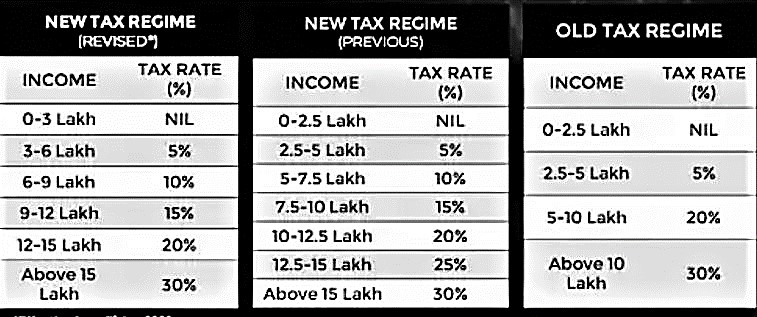

PERSONAL INCOME TAX

INDIRECT TAX

OTHERS

|

Presumptive Taxation Scheme (PTS) |

|

Under the presumptive taxation scheme (PTS), a taxpayer is exempt from maintaining books of accounts as small taxpayers had to bear additional costs in maintain them. It is defined under three different sections—44AD, 44ADA and 44AE—of the Income-tax Act. |