900 319 0030

enquiry@shankarias.in

Pakistan has announced that the government would introduce interest-free banking under the Islamic law by 2027.

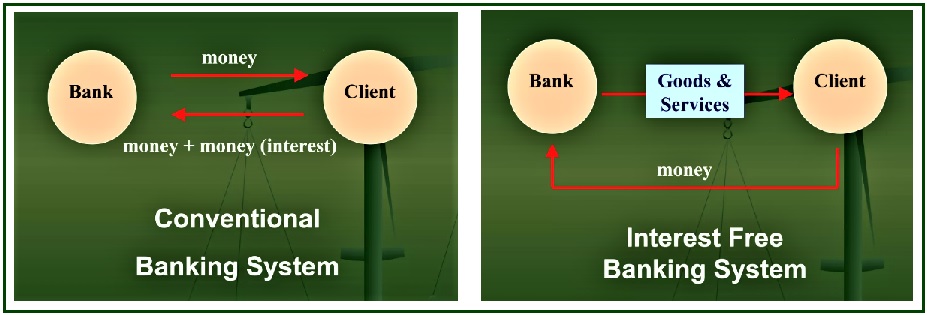

How can an interest-free banking system work?

How can an interest-free banking system work?

Pakistan became the first Muslim country to officially declare modern bank interest as Riba.

Quick facts

Federal Shariat Court (FSC)

Ulema

Riba

References