900 319 0030

enquiry@shankarias.in

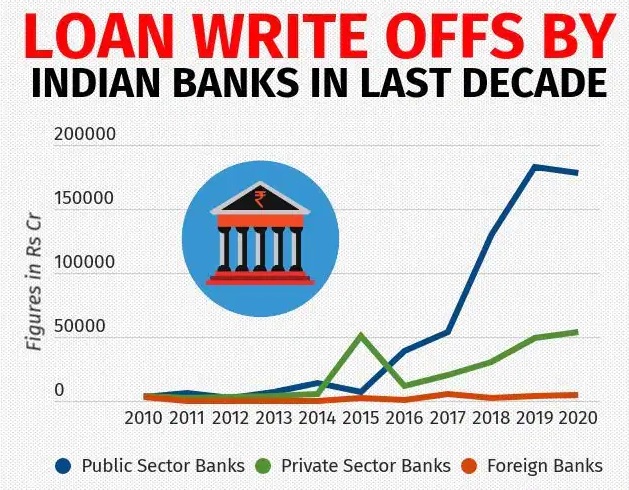

As per the government, during the last five years (2017-18 to 2021-22), scheduled commercial banks wrote off non-performing assets (NPAs) worth Rs 9,91,640 lakh crore.

Quick Facts

Non-performing assets (NPAs)

References