900 319 0030

enquiry@shankarias.in

What is the issue?

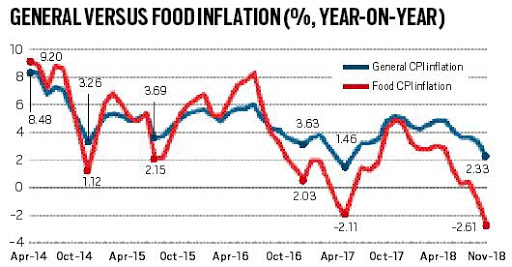

The food inflation which has been low for an extended time can affect the economy and political scenario.

How were the food prices in previous years?

What are the twin implications of extended low food inflation?

What is the reason for such low levels of food inflation?

Source: The Indian Express