900 319 0030

enquiry@shankarias.in

The Finance Ministry report highlights two key areas of concern for the Indian economy - the fiscal deficit and the current account deficit.

References

Quick facts

Glossary

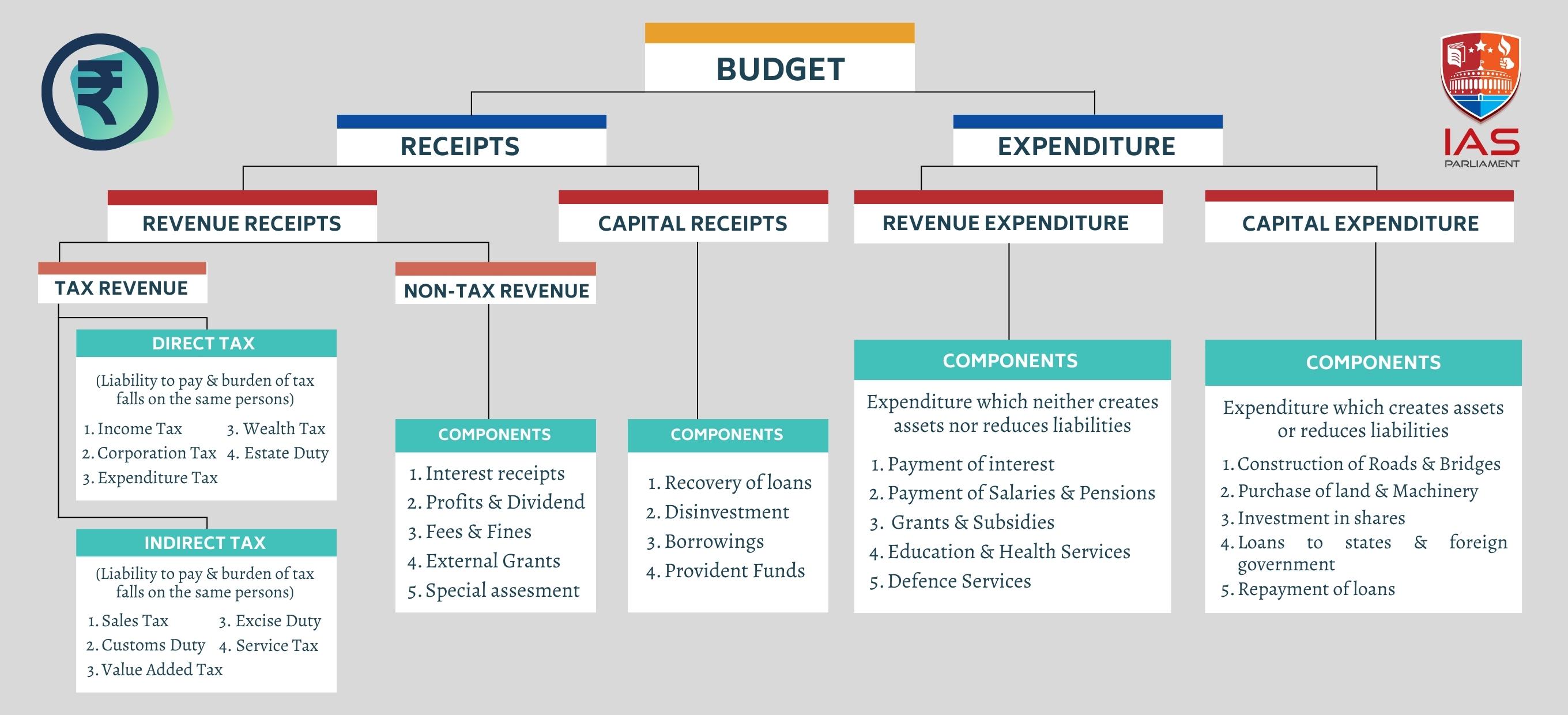

Revenue deficit = Total revenue expenditure – Total revenue receipts

Fiscal deficit = Total expenditure – Total receipts excluding borrowings

Primary deficit = Fiscal deficit-Interest payments