900 319 0030

enquiry@shankarias.in

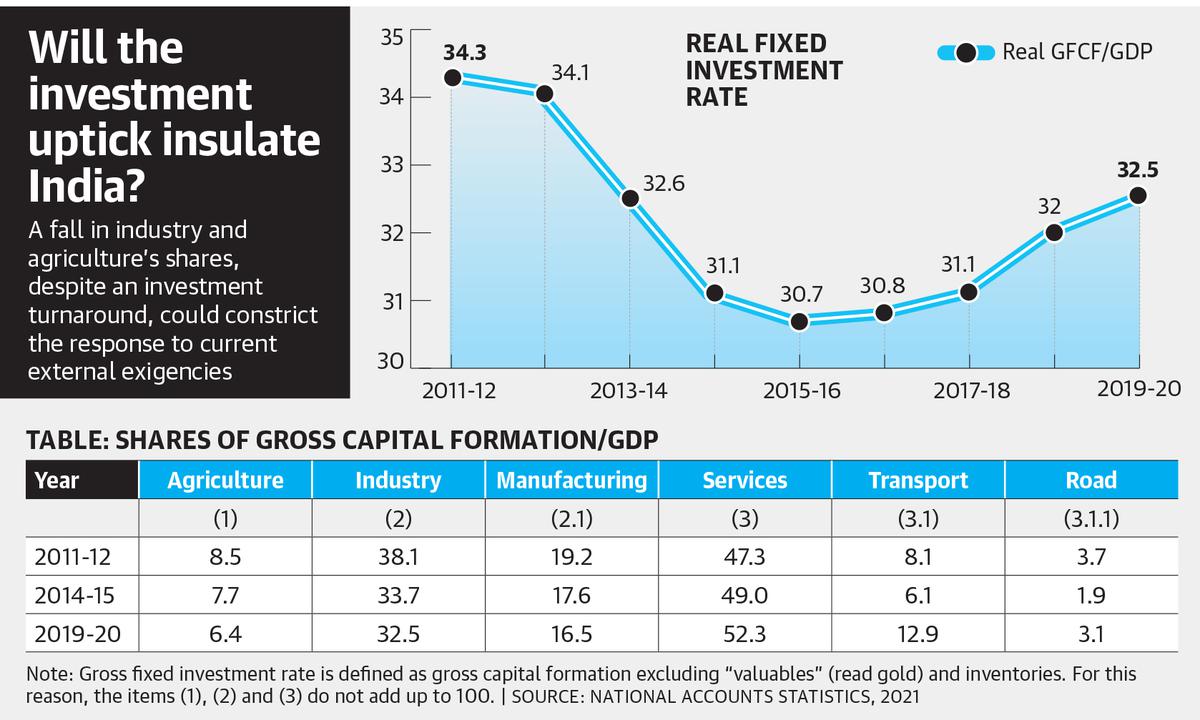

The Finance Minister, Nirmala Sitharaman, said that India’s long-term growth prospects are embedded in public capital expenditure programmes.

Reference