900 319 0030

enquiry@shankarias.in

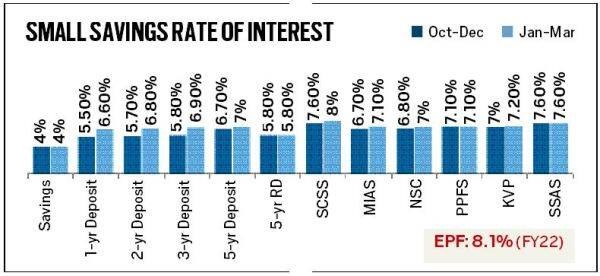

Amid rising yields on government securities, the Finance Ministry hiked interest rates on eight of the 12 small savings schemes by 20 to 110 basis points for the January to March 2023 quarter.

While the hike will serve as protection against high inflation and interest rates, the small savings rates are still below desired levels.

The RBI in its Monetary Policy Report (September 2023) had noted that with government bond yields increasing, the revised small savings rates were 44-77 basis points below the formula implied rates.

Reference