An experiment carried out in National Ignition Facility (California) has made a breakthrough in nuclear fusion research.

Base load energy refers to the minimum amount of electric power needed to be supplied to the electrical grid at any given time.

Department for Promotion of Industry and Internal Trade has notified this new Scheme for J&K and is effective from April, 2021 to March, 2037.

Finance Minister has said that it cannot reduce taxes on petrol and diesel as it has to bear the burden of payments in lieu of oil bonds issued by the previous government to subsidise fuel prices in 2012-13.

Oil bonds are issued by the government to compensate oil marketing companies (OMCs) to offset losses that they suffer to shield consumers from rising crude oil prices.

These bonds issued by the Central government in 2017 will come up for redemption between 2028 and 2035.

Recapitalisation bonds, issued by the government, will inject capital into state-owned banks (PSU banks) and other institutions that were stressed by bad loans.

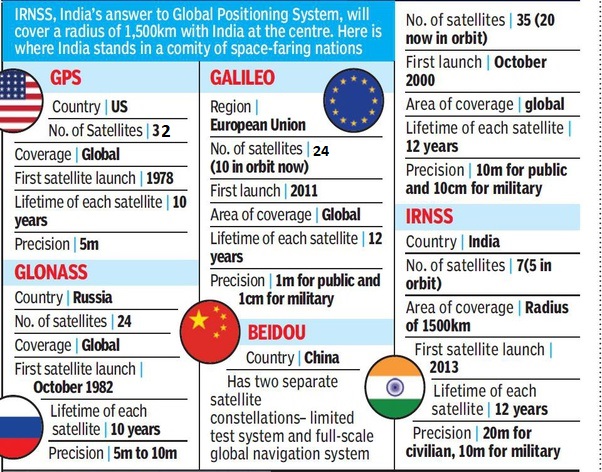

Quasi-Zenith Satellite System

Source: PIB, The Hindu, The Indian Express