900 319 0030

enquiry@shankarias.in

Why in news?

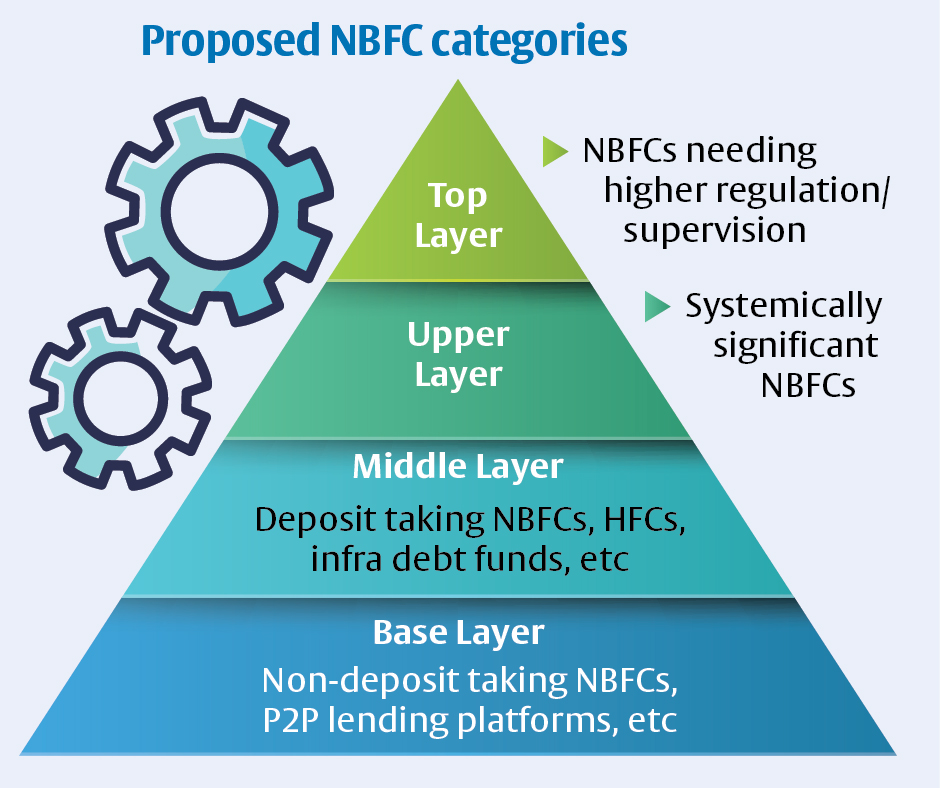

The RBI has issued a fresh set of rules for non-banking finance companies (NBFCs) which limits lending to IPO investors to Rs 1 crore per borrower from April 1, 2022.

References