900 319 0030

enquiry@shankarias.in

Why in news?

The Reserve Bank of India (RBI) recently removed three state-owned banks from the prompt corrective action (PCA) framework.

What is Prompt Corrective Action?

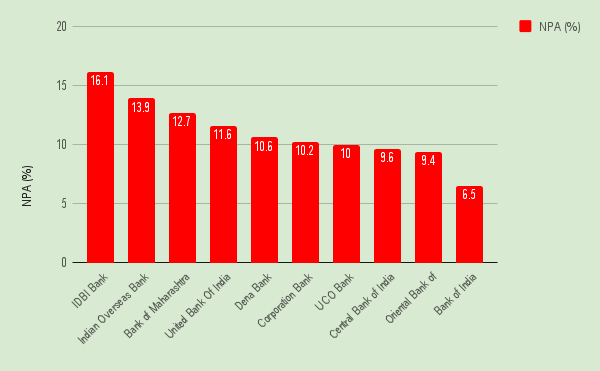

What are the underlying reasons?

Source: Financial Express

Capital Conservation Buffer