900 319 0030

enquiry@shankarias.in

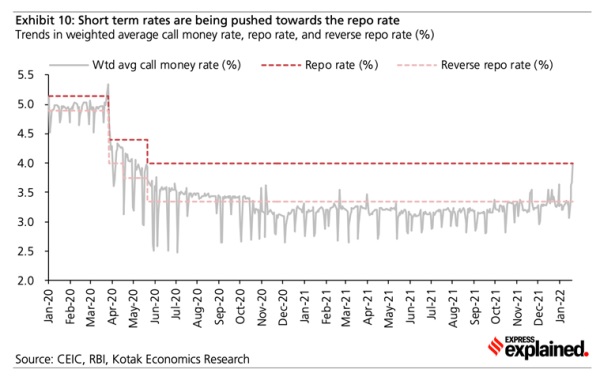

In a recent report, State Bank of India, which is the largest public sector bank in the country, has stated that they believe the stage is set for a reverse repo normalisation.

Reference