900 319 0030

enquiry@shankarias.in

What is the issue?

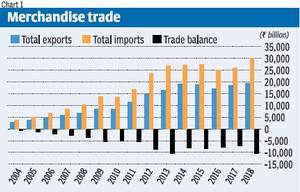

What is the current trade scenario?

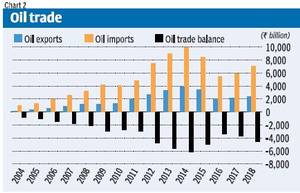

How was the oil price impact?

Is oil price the only factor for trade deficit?

What are the other factors?

What does it imply?

Source: Business Line