900 319 0030

enquiry@shankarias.in

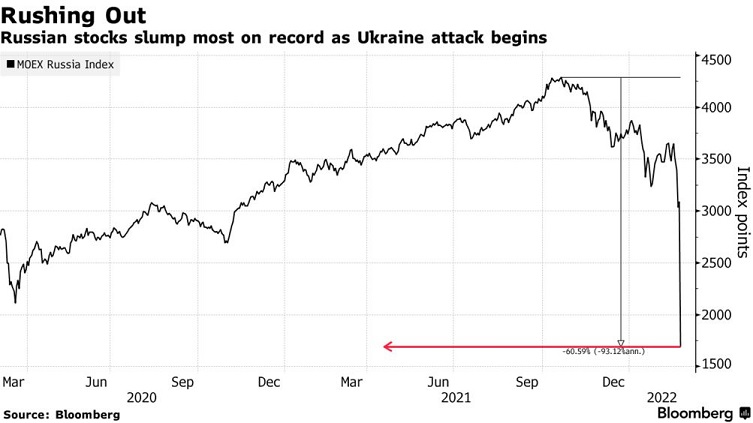

In the wake of sanctions against Russia, debates have been mounting for pushing the Rupee-Rouble trade arrangement.

The Russian ruble or rouble is the official currency of the Russian Federation.

SWIFT is a global secure interbank system that communicates payment instructions and enables transactions between banks from all the countries around the world.

Reference