900 319 0030

enquiry@shankarias.in

What is the issue?

Manipur suffered a setback to its finances when the state lost the special status owing to the Fourteenth Finance Commission recommendations.

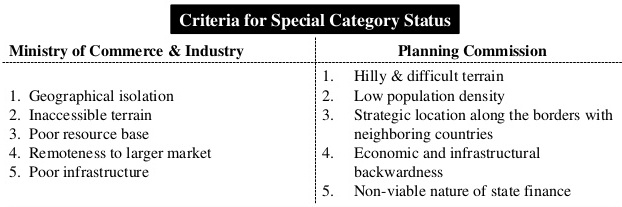

What is Special Category Status?

What kind of assistance do SCS States receive?

Why A.P. claimed for SCS status recently?

What has been the Centre’s response to A.P.?

What does it mean for Manipur?

Source: Indian Express & The Hindu