900 319 0030

enquiry@shankarias.in

Why in news?

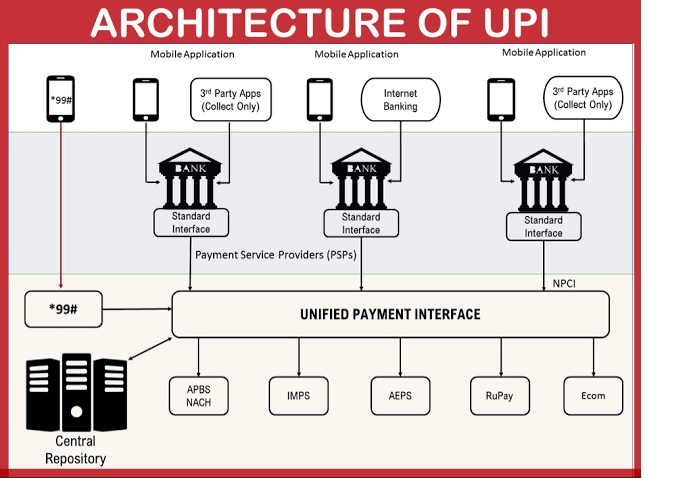

The RBI has announced a proposal to popularise UPI payments on feature phones which would be the third iteration of the feature phone payments push in the country.

The merchant discount rate is the rate charged to a merchant for accepting payment from their customers through digital means.

References