900 319 0030

enquiry@shankarias.in

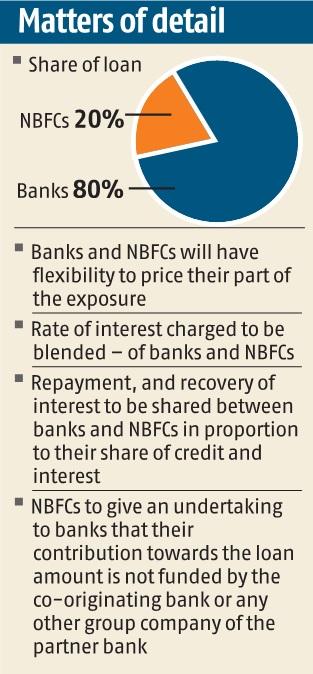

The RBI’s decision to permit banks to co-lend with all registered NBFCs (including HFCs) based on a prior agreement has led to unusual tie-ups like the one between the State Bank of India (SBI) and Adani Capital.

Reference