900 319 0030

enquiry@shankarias.in

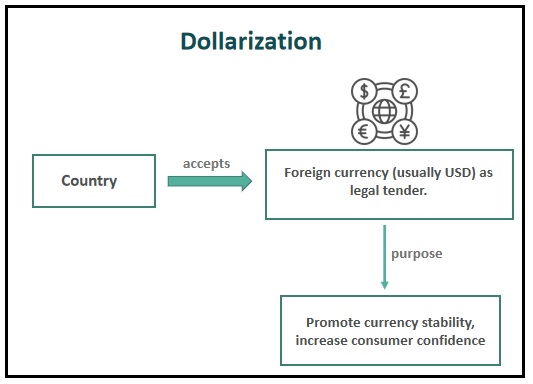

Javier Milei, the recent winner of Argentina’s presidential election, has drawn attention for his plan to replace the country’s currency “Peso” with the dollar.

3 fully dollarised economies - Ecuador, Panama and El Salvador have had successful economic outcomes following dollarisation.

|

Ecuador model of dollarisation |

|

Seigniorage is a term that refers to the profit that a government or a central bank makes by issuing money.

|

De-dollarisation |

|

References