900 319 0030

enquiry@shankarias.in

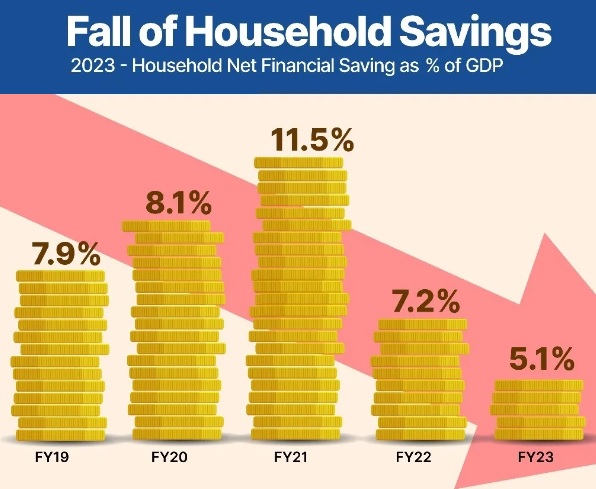

Household sector’s savings in financial assets has shown a sharp decline to 5.1% of GDP in 2022-23.

Household savings rate = (Household savings/Personal disposable income ) x 100%

|

Factors influencing Household Savings |

|

Status of Household Savings

What are the implications of fall in household savings?

References