SEBI floated a consultation paper that proposed additional disclosures from Foreign Portfolio Investors (FPIs).

|

|

Foreign Direct Investment (FDI) |

Foreign Portfolio Investment (FPI) |

|

Definition |

Investment made by foreign investors to obtain a substantial interest in the enterprise located in a different country. |

Investing in the financial assets of a foreign country, such as stocks or bonds available on an exchange. |

|

Type |

Direct Investment |

Indirect Investment |

|

Market |

Inflows in primary market |

Inflows in secondary market |

|

Role of Investors |

Active Investor |

Passive Investor |

|

Degree of Control |

High control |

Very low control |

|

Term |

Long term investment |

Short term investment |

|

Investment is done on |

Physical assets of the foreign country |

Financial assets of the foreign country |

|

Entry and Exit |

Difficult |

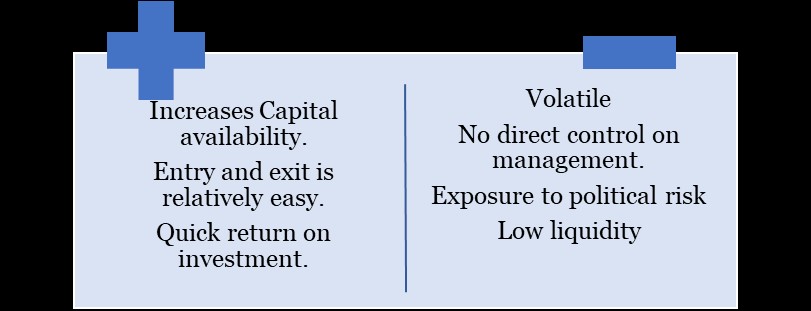

Relatively easy |

|

Risks Involved |

Stable |

Volatile |