900 319 0030

enquiry@shankarias.in

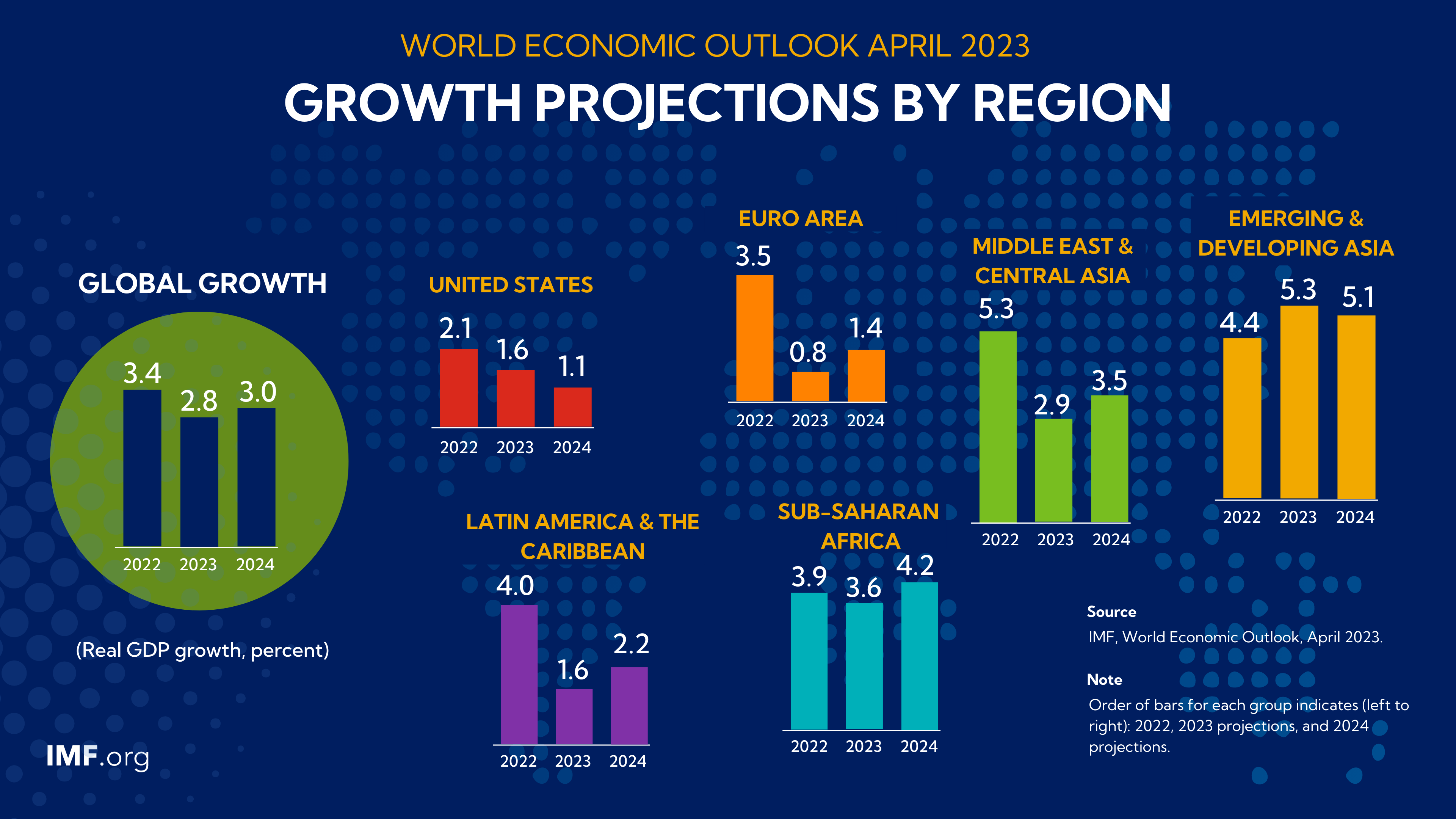

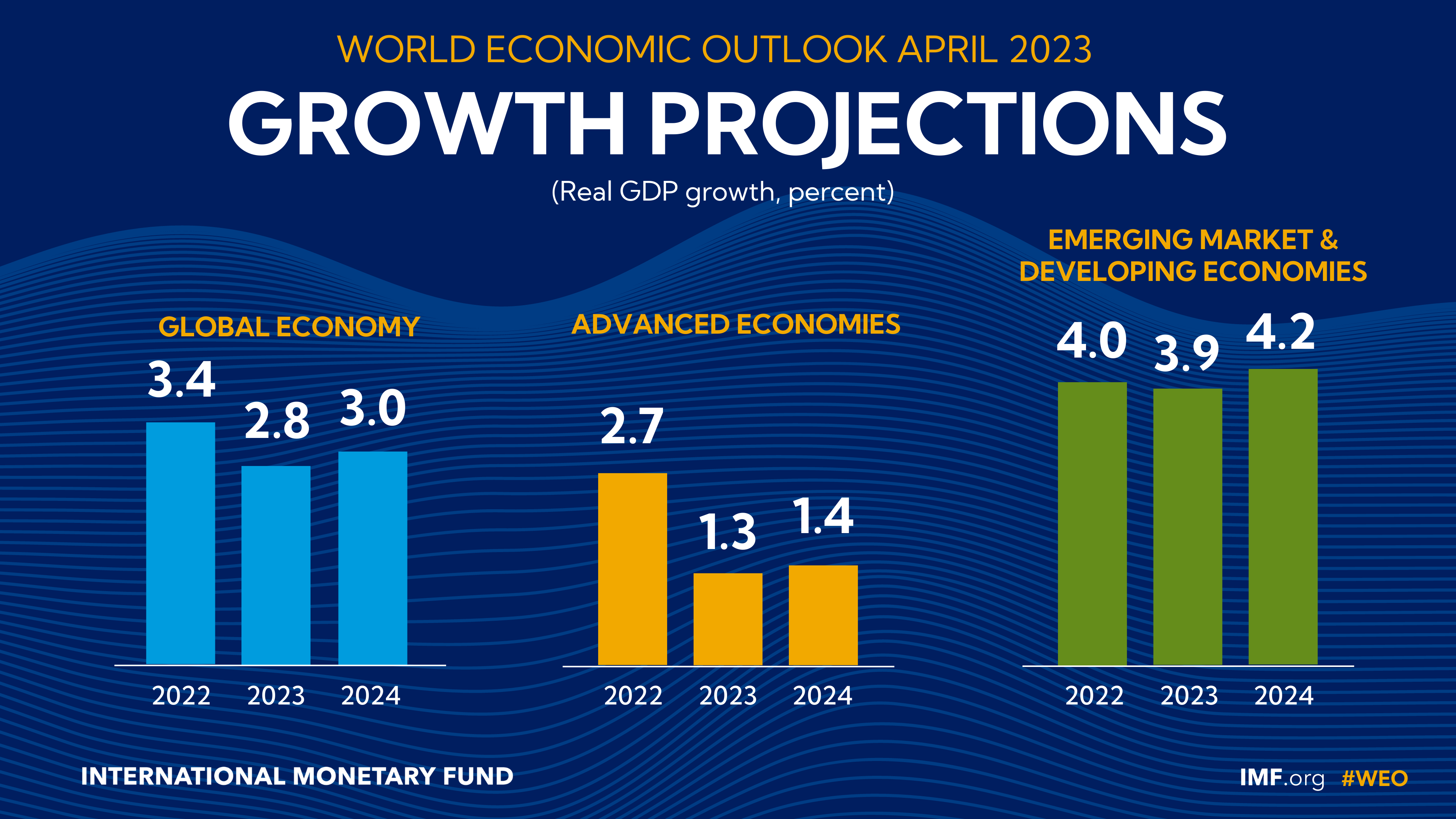

IMF’s latest World Economic Outlook (WEO) has stated that outlook is uncertain again amid financial sector turmoil, high inflation, ongoing effects of Russia’s invasion of Ukraine, and three years of COVID.

Global Prospects and Policies

The Natural Rate of Interest: Drivers and Implications for Policy

Coming Down to Earth: How to Tackle Soaring Public Debt

Geo-economics Fragmentation and Foreign Direct Investment