900 319 0030

enquiry@shankarias.in

Recently, a MoU has been signed between India and UAE on Local Currency Settlement System.

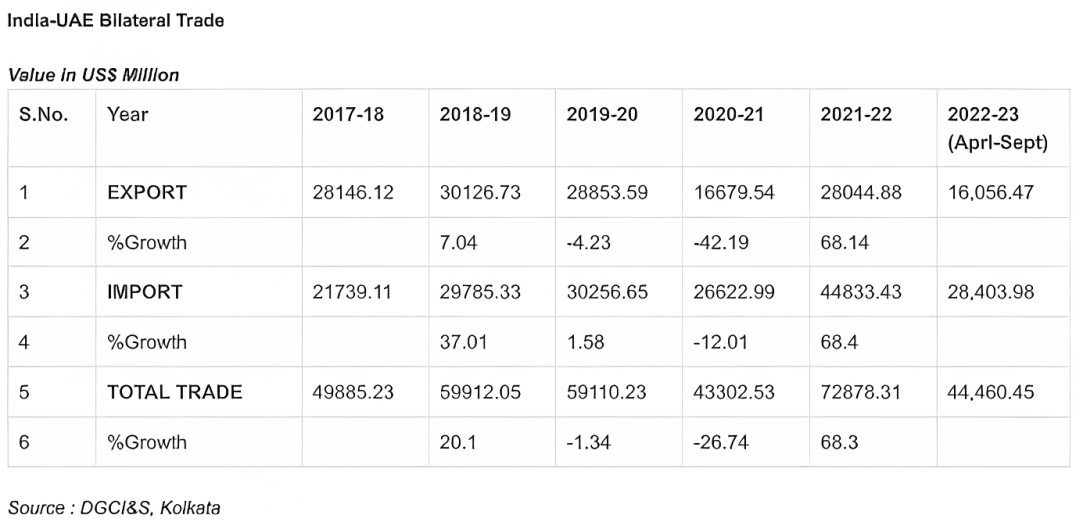

CEPA is the free trade agreement between India and UAE that was signed in 2022 and covers the trade in services and investment, and other areas of economic partnership.

Other MoU signed between India and UAE

UPI-IPP Linkage