900 319 0030

enquiry@shankarias.in

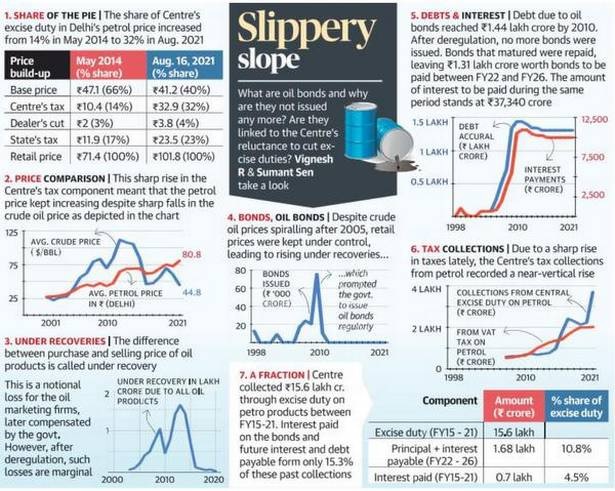

The Centre has argued that it cannot reduce taxes on petrol and diesel as it has to bear the burden of payments with respect to oil bonds issued by the previous UPA government.

References