900 319 0030

enquiry@shankarias.in

Base Erosion and Profit Shifting (BEPS)

Chaukhandi Stupa

Jnanpith Award

Foreigners (Tribunals) Order, 1964

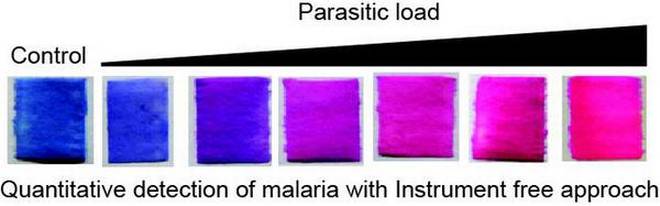

Malaria Detection Chromatography

Source: PIB, the Hindu