900 319 0030

enquiry@shankarias.in

Recently in a landmark unanimous judgment, the Supreme Court struck down electoral bond scheme as “unconstitutional and manifestly arbitrary”.

To know more about electoral bond scheme click here

Article 19 (1)(a) in the Constitution of India guarantees all citizens the “right to freedom of speech and expression

This is violative of the principle of free and fair elections and political equality captured in a value of ‘one person, one vote’

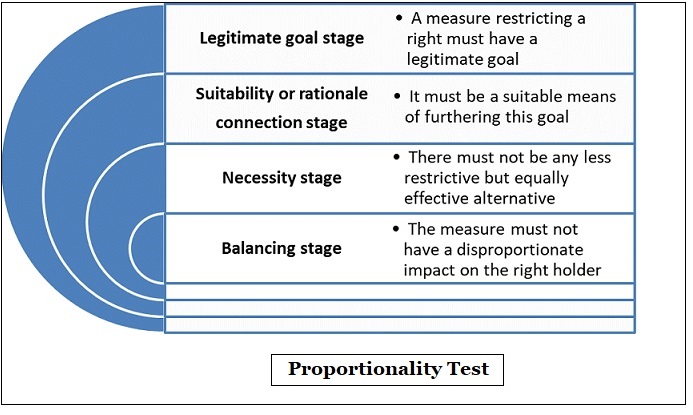

The proportionality test was laid down in 2017 verdict in the KS Puttaswamy case which upheld the right to privacy.

Section 29C of RPA, 1951 mandated political parties to declare all contributions exceeding Rs 20,000