900 319 0030

enquiry@shankarias.in

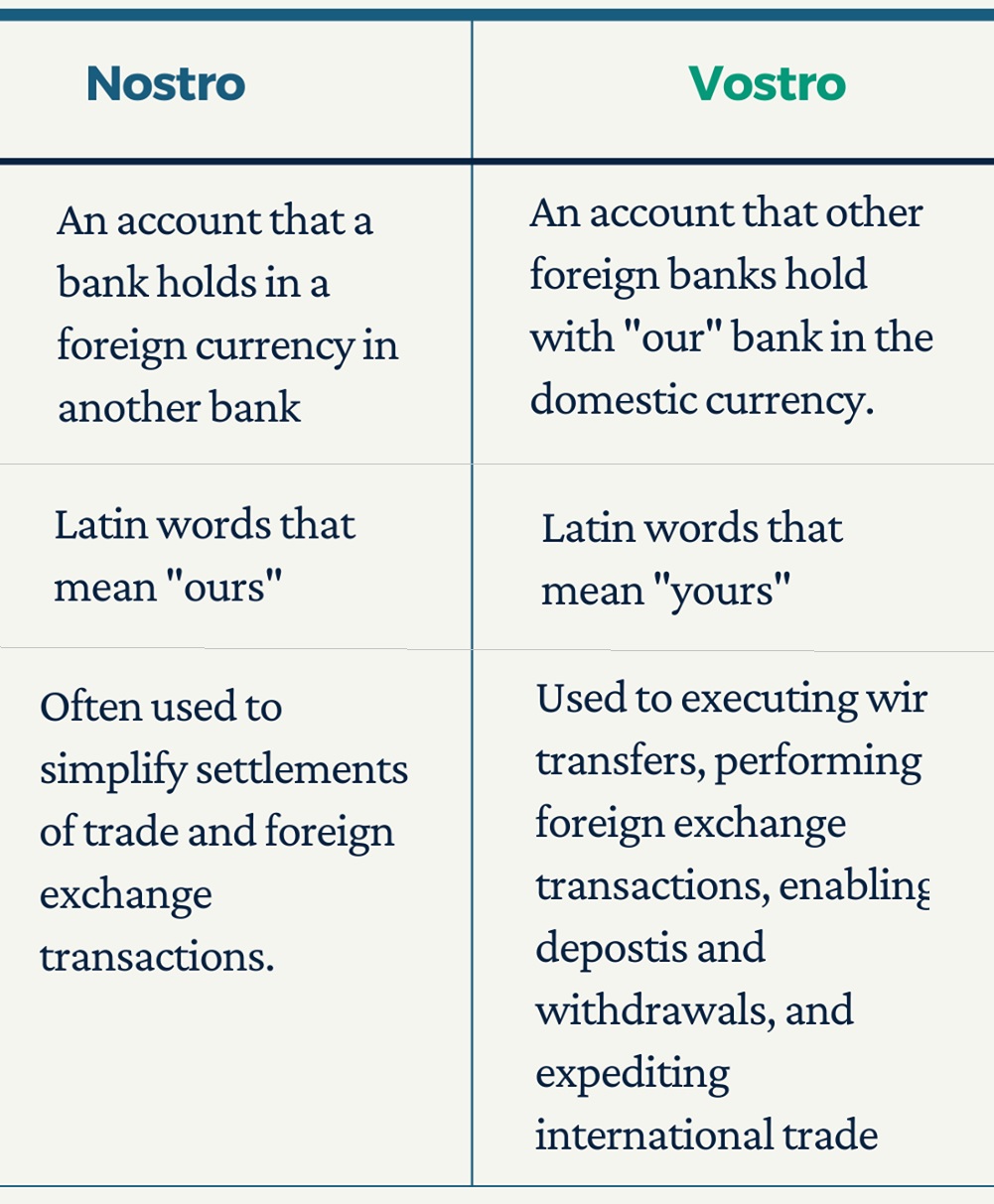

Recently, government officials informed that 20 Russian banks Rosbank, Tinkoff Bank, Centro Credit Bank and Credit Bank of Moscow have opened Special Rupee Vostro Accounts (SRVA) with partner banks in India.

Components of the framework

Eligibility criteria of banks

As per the Bureau for International (BIS) Settlements’ Triennial Central Bank Survey 2022, the U.S. dollar was the most dominant vehicle currency accounting for 88% of all trades. The INR accounted for 1.6%.

Reference