900 319 0030

enquiry@shankarias.in

Why in news?

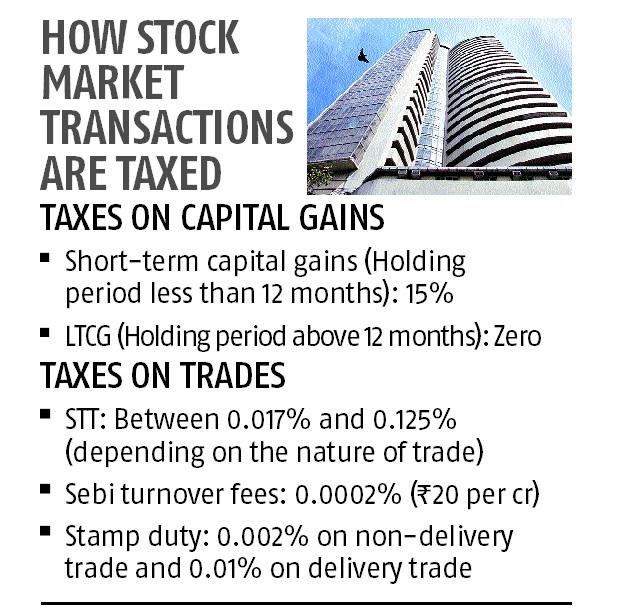

Bombay Stock Exchange (BSE) submitted its suggestion on long-term capital gains (LTCG) tax on equity investments to the union government.

What is LTCG tax exemption?

What is the recent suggestion on LTCG?

How LTCG is misused?

Source: Business Standard