900 319 0030

enquiry@shankarias.in

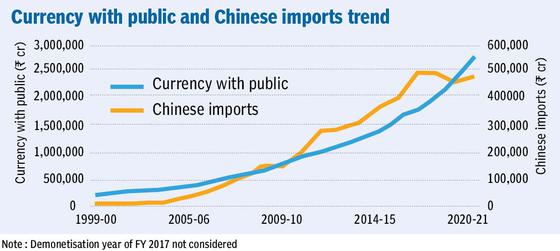

The high level of illegal Chinese imports and a dysfunctional trade credit system are keeping cash usage high.

Trade credit is an agreement made between two businesses where the customer can make purchases on the account without making cash payment upfront.

The RBI’s Financial Stability Report of July 2021 shows a steady increase in cash holdings by a sample of 1,360 listed private non-financial companies.

References