900 319 0030

enquiry@shankarias.in

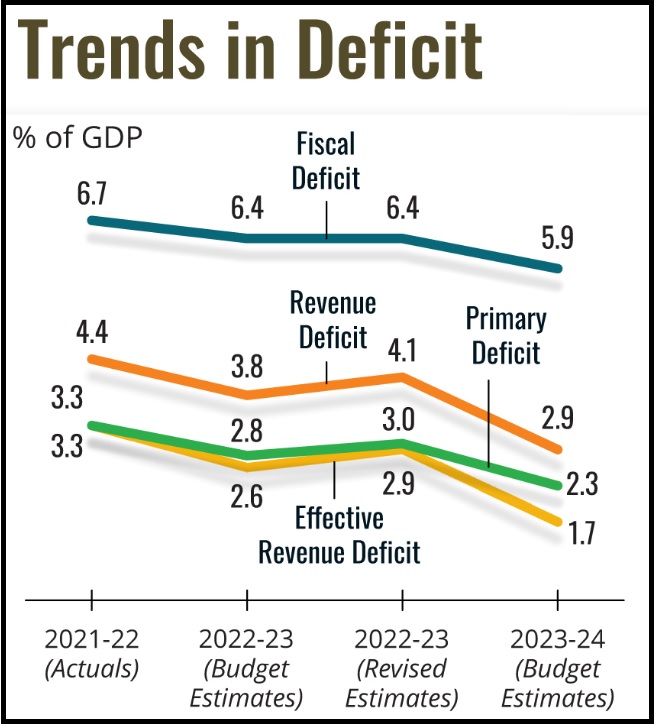

The 2023-24 Budget’s attempt to address the aspirations of different segments of society is a good effort in a difficult situation and the main focus is on fiscal consolidation.

To know about the summary of Budget, click here

What are the key facts of budget 2023-24?

References