900 319 0030

enquiry@shankarias.in

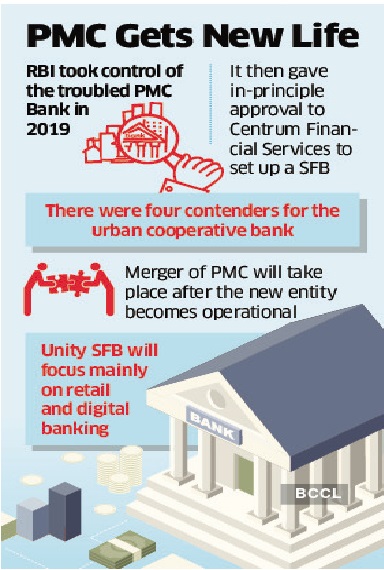

The RBI has issued a Small Finance Bank (SFB) license to the consortium of Centrum Financial Services and Digital payments platform BharatPe.

In the buy-now-pay-later (BNPL) and micro-lending models, companies like Paytm, Google Pay, Amazon Pay, etc. have partnered with NBFCs to assess creditworthiness of an existing customer and present it to the lender as a potential borrower.

Source: The Indian Express, RBI