900 319 0030

enquiry@shankarias.in

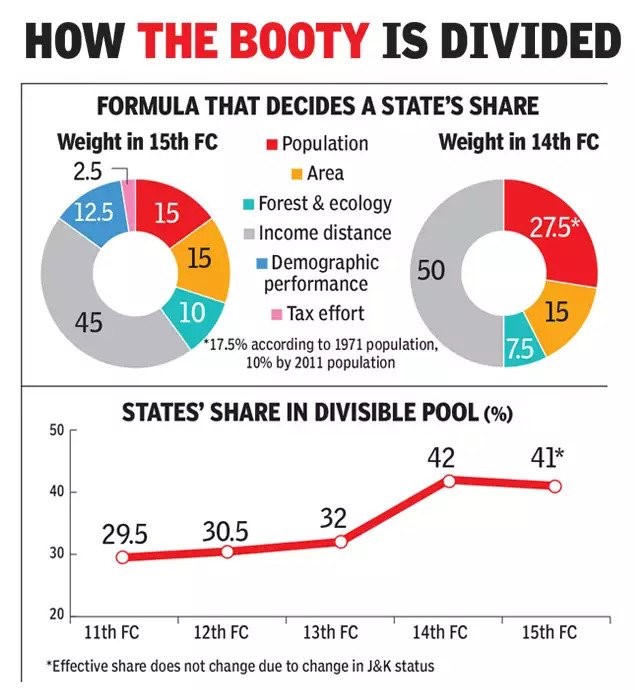

Union tax revenue among States is distributed by the Finance Commission based on equity and efficiency principles.

The Finance Commission is a constitutional body that was established under Article 280 of the Indian Constitution.

Since the 10th Finance Commission, the Commission has recommended a single distribution formula for both income tax and Union excise duties. Thus, the Finance Commissions have always favoured assigning more than 75% weight to equity indicators.

To know about the report of 15th Finance Commission, click here

Reference