900 319 0030

enquiry@shankarias.in

Recently, India released a document titled ‘Re-examining Narratives: A Collection of Essays’ to present alternate perspectives on economic policy that have long-term implications for India’s growth and development priorities.

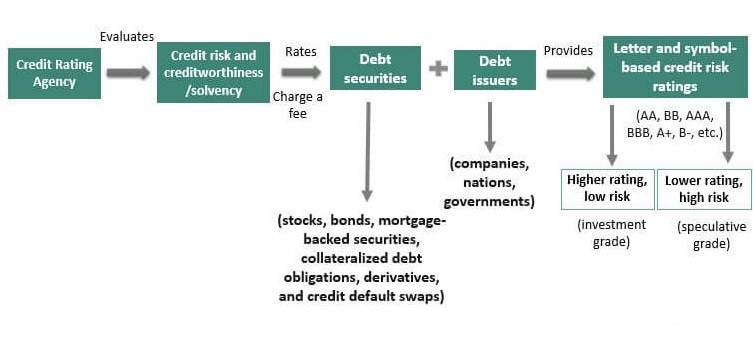

6 Credit Rating Agencies (CRA) registered under SEBI are CRISIL, ICRA, CARE, SMERA, Fitch India and Brickwork Ratings.

What is sovereign credit rating?

While S&P and Fitch rate India at BBB, Moody’s rates the South Asian country at Baa3, which indicates the lowest possible investment grade, albeit with a stable outlook.

To know more about CRA, click here

References