900 319 0030

enquiry@shankarias.in

To know about Part-1, click here

|

Revised Estimates 2023-24 |

|

|

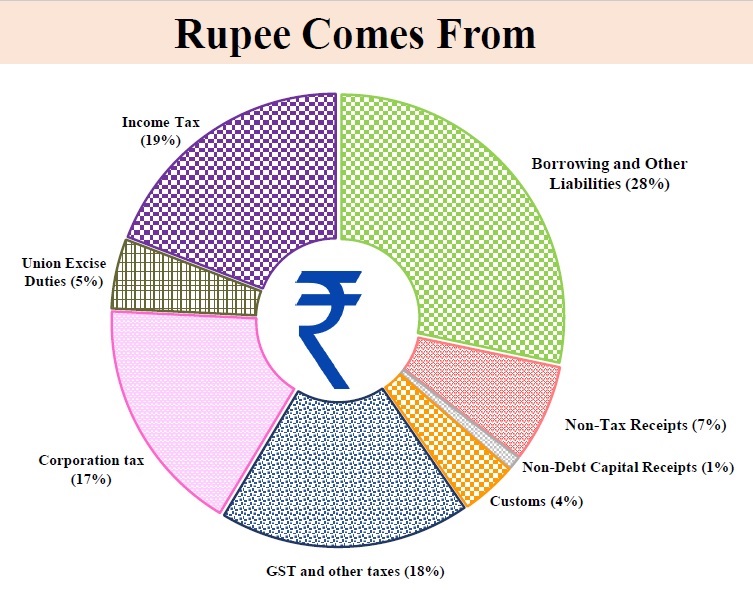

Total receipts other than borrowings |

27.56 lakh crore |

|

Tax receipts |

23.24 lakh crore |

|

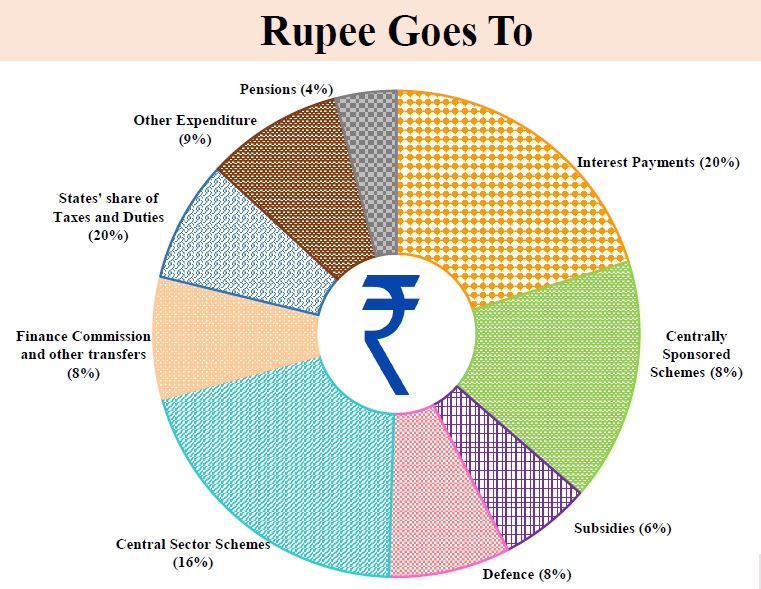

Total expenditure |

44.90 lakh crore |

|

Revenue receipts |

30.03 lakh crore |

|

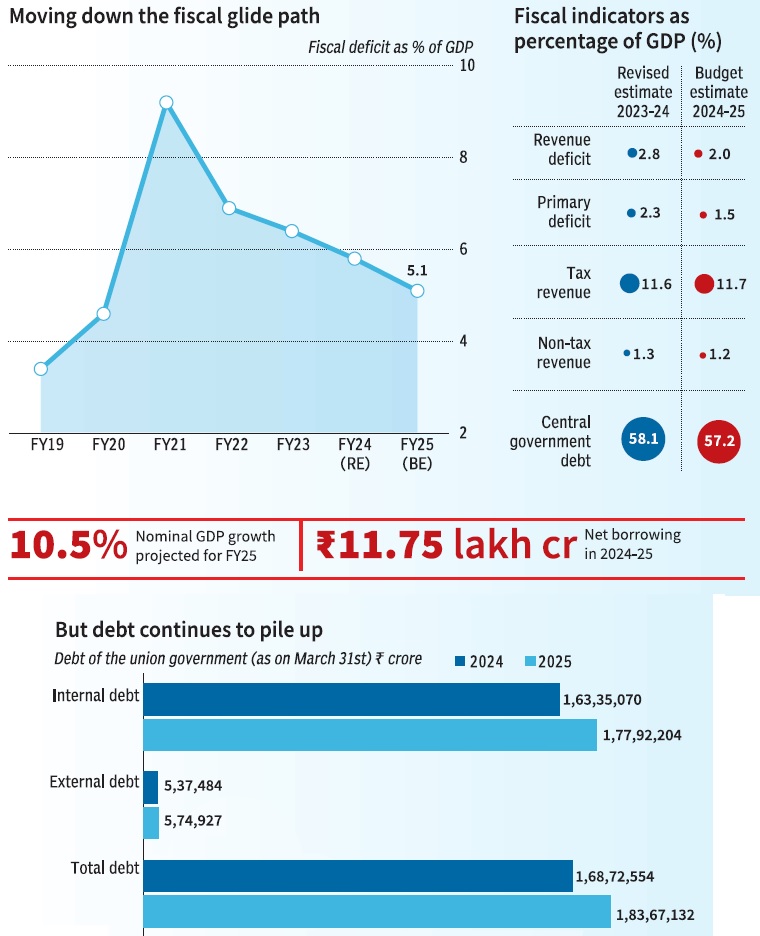

Fiscal deficit |

5.8% of GDP |

|

Budget Estimates 2024-25 |

|

|

Total receipts other than borrowings |

30.80 lakh crore |

|

Tax receipts |

26.02 lakh crore |

|

Total expenditure |

47.66 lakh crore |

|

Estimated fiscal deficit |

5.1% of GDP ( Aims to reduce fiscal deficit below 4.5 % by 2025-26) |

|

|

|

Tax proposals

Direct taxes

Indirect Taxes

References