900 319 0030

enquiry@shankarias.in

Why in news?

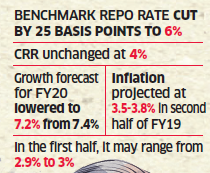

The Reserve Bank of India recently cut the repo rate by 25 basis points to 6%, in its recent bi-monthly meeting.

What are the highlights?

What are the likely implications?

Why is the downward revision of GDP growth?

What is the inflation outlook?

Source: Indian Express, The Hindu

Author: Shankar Civil Service Coaching Center Bangaluru

Visit for Daily Current Affairs on Indian Economy